There are so many priorities in the working day, it can be hard to stay focused on what’s happening with your business cash flow.

We all know the basics: if your business runs out of cash it won’t be able to operate. And if you aren’t able to spot trends and possible bottlenecks ahead, it can compromise your long-term investment and development plans. It undermines your ability to earn returns on any cash surpluses and trim costs to avoid cash shortages.

How often you forecast cash flow depends on the soundness of your business. If your business is struggling, you should be forecasting and revising your cash flow every day.

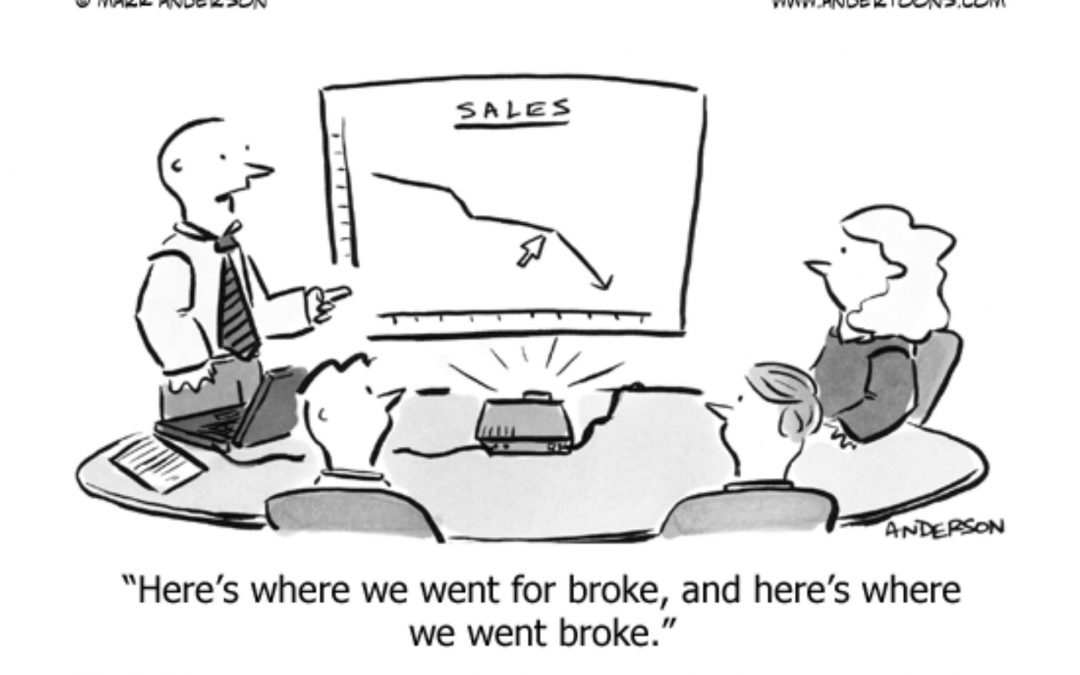

It sounds simple to track sales on the one hand and expenses on the other – then compare the two. But a massive 65 percent of failed businesses say they closed down because of financial mismanagement, including issues such as lack of cash flow visibility. In other words, they didn’t know if they were making more than they were spending.

Take the time for regular cash flow monitoring and make cash flow forecasts part of your business planning. Get the best possible clarity around cash flow.

Why are people losing sight of cash flow?

Everyone knows a business needs to stay in the black. It’s not a new idea. So it can be hard to imagine why a business would lose sight of cash flow. Until you’re in business yourself and you realise tracking small business cash flow isn’t as easy as it seems.

For small businesses, this can involve:

- Keeping track of all your expense receipts – which gets really tricky if there are multiple people making purchases

- Recording all your sales revenue – making sure to account for discounts you might have given

- Entering everything into your cash flow Excel spreadsheet or Google Sheet- including double and triple checks to make sure everything is entered correctly.

You may have to rely on employees or business partners to supply a lot of this information. Their paperwork will sometimes have scribbled notes in the margins, requiring a follow-up phone call. It takes a lot of time, patience and energy before you’re even ready to punch the numbers into a spreadsheet.

But even if you’re vigilant, there’s a lag between when a sale or expenditure happens and when it’s entered into your spreadsheet. You’re taking a series of snapshots of your cash flow, and there can be big blind spots in between.

As business picks up, with more sales and more expenditure happening all the time, those blind spots become more significant. More things happen in between each cashflow snapshot. And cash flow snapshots get further apart because you’re too busy to update spreadsheets.

Consider using cloud accounting software

Because money in and money out is the ultimate measure of business health and sustainability, you know you must watch it carefully. Cloud accounting software can automate the process for you. In fact, 98% of users of accounting software recommend it to others.

Here’s how it works:

Cloud accounting software is generally sold on a flat monthly subscription. You don’t need to download anything and you can run it easily off your existing laptop, desktop or smartphone.

It can link to your business bank account (and point-of-sale system) to track sales and expenses as they happen, with no data entry from you. Because the data comes straight from the bank, it’s clean and accurate. Smart accounting software will also send out your invoices, so it shows what you’re owed. Next, the system pools all the data to create a dashboard of your financial situation, which is automatically updated every day.

Accounting software probably only needs to save you one or two hours a month to pay for itself. In reality, because it will save you time that you can spend on other areas of your business, it will do that many times over.

Talk to us about accounting software for the health of your business.