Small business budgets are empowering. They give you the knowledge and insight to eliminate wasteful spending and get to profitability faster.

When setting a business budget, you need good numbers. Don’t guess at what’s coming in and what’s going out. You could be making assumptions that just aren’t true. Take the time to look into your accounts and dig out the real figures. It might sound like hard work but it’s worth it.

The numbers that matter when setting a budget

So what are the key figures to consider when setting a budget? Rather than looking over large sets of numbers than can blur into one, keep in mind the following financial reports:

- Profit & Loss report

- Balance sheet

- Trial balance

Profit & Loss report

This report tells you at a glance whether you’re making money or losing it. To do that, you’ll subtract your expenses from your income. To help you get started, talk to your Walker Wayland Accountant.

Income (revenue)

How much money are you generating from sales of your products or services? It helps to break these into:

- recurring income – regular and reliable revenue from client retainers and contract work

- expected income – a forecast of what your business is likely to earn

Expenses (costs)

How much money are you spending on business costs such as staff, raw materials and marketing? As with income, it helps to break these into:

- recurring expenditure – your monthly payments for rent, utilities, payroll and so on

It can be easy to overlook some of the costs of doing business. To help capture them all, consider the following issues:

- Depreciation – business assets, such as computers and equipment, lose value as they get older, and should be counted as a cost

- Overheads – make sure you don’t overlook fixed costs such as rent or energy (eg, electricity, gas, transport fuel)

- Payroll – the total cost of employing your staff including insurance, taxes and benefits

- Debt repayments – regular outgoings to repay loans or other business investments

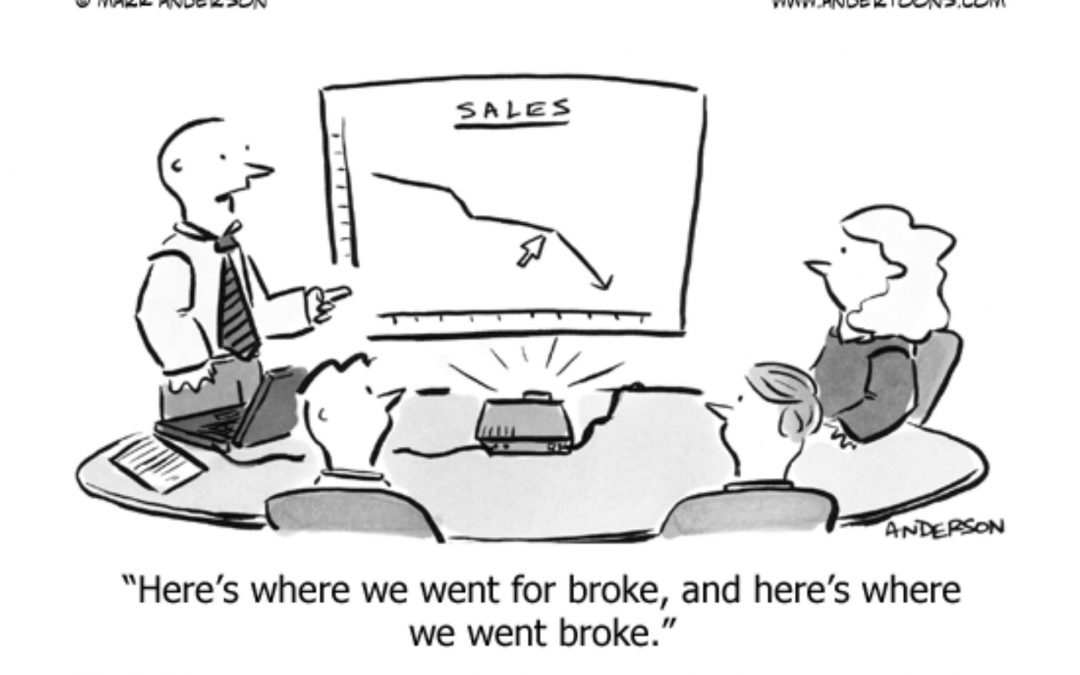

If you have more revenue coming in than costs going out, you’re making a profit. If it’s the other way around, you’re making a loss. A loss is okay in certain situations but losses aren’t sustainable over the long term.

If you make a profit, think carefully about what to do with it. Could you:

- drive bigger profits by reinvesting in the business?

- save money by paying down debts quicker?

- keep cash in reserve to ride out future revenue dips (this is an especially big consideration for seasonal businesses)?

There are many ways to treat a profit and setting a business budget will help you decide on the right strategy. A financial advisor will help you come up with the most tax-efficient plan.

Balance sheet

This tells you what your business is worth. It’s the difference between what you own and what you owe. On the plus side of the balance sheet you’ll find:

- the value of the assets owned by your business, such as work tools or real estate

- cash you have in the bank

- invoices that have been sent to clients but have not yet been paid

All of these are business assets. On the other side of the balance sheet are your liabilities, which include:

- expenses that have been incurred but not yet paid, such as bills from suppliers

- taxes that are due to be paid in the near future

- loans or other business debts that you have

Trial balance

A trial balance is another very useful accounting concept. It shows all your debits, credits, assets and liabilities on a single document. In other words, it represents the entire balance of your business accounts.

Creating your first small business budget

Now that you have all your current financial information in black and white, you can create a forward-looking budget. It will tell you how much you:

- spend running the business

- can invest to improve the business

- can pay yourself (and any shareholders)

A budget will also give you a much better idea of what your cash flow will look like. This will help you avoid running out of money and getting into a tight spot with creditors. Your budget will also show you where you can make savings.

Don’t be afraid to ask for help

Setting a budget isn’t complicated but it can still help to involve an expert. Walker Wayland can double-check the numbers and help you make realistic predictions about business growth, upcoming expenses, and tax exposure. They can also advise you on what to do if the actual numbers deviate from the predicted ones.

For more information, talk to your Walker Wayland Accountant.